Ethereum’s breakout above $2,000 this May sent shockwaves through the derivatives market, with open interest in ETH futures jumping by an eye-catching 50% in just two weeks. As traders poured into leveraged positions, the action revealed shifting sentiment — but also set the stage for increased market fragility if bullish momentum falters.

This article breaks down the rapid rise in open interest, contrasts spot and futures activity, highlights which exchanges drove the surge, and analyzes what this means for Ethereum’s next big move.

Open Interest Climbs as Ethereum Price Breaks Out

On May 8, Ethereum broke out above $2,000 for the first time since March, ending weeks of sideways trading below the psychological threshold. The move unleashed a wave of speculative activity: futures open interest soared from $20.77 billion at the start of May to $31.16 billion by mid-month, a 50% increase.

The timing is crucial. Open interest ramped up after the breakout, suggesting that traders were not anticipating the move, but instead rushed to add leveraged exposure once ETH showed real strength. This points to a reactive market, with momentum chasers crowding in after confirmation of an uptrend.

Spot vs. Futures: Diverging Sentiment

While spot prices climbed sharply — ETH reached $2,700 by May 13 — the surge in open interest far outpaced increases in spot trading volumes. In other words, the market’s enthusiasm was largely fueled by futures and derivatives, not by underlying spot demand.

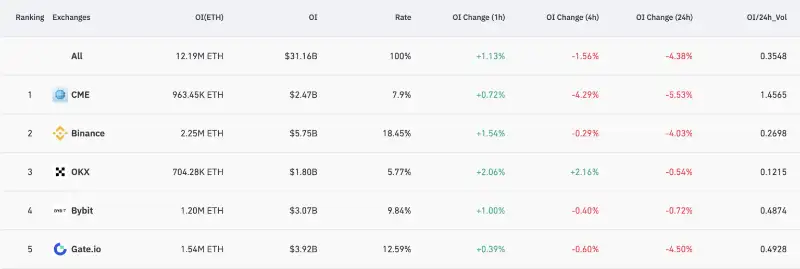

Exchange Breakdown: Retail Drives the Move

Most of the action was concentrated on retail-friendly platforms like Binance and Bybit, where traders rushed to open new positions. In contrast, the CME — a key venue for institutional investors — posted a more muted response, even seeing a 5% decline in open interest over a 24-hour span. This divergence suggests the rally was retail-driven, with institutions taking a more cautious stance.

- Binance and Bybit: Large inflows and aggressive futures positioning.

- CME: Open interest decline, reflecting cautious or profit-taking institutional flows.

Risks: Rapid Buildup Raises Liquidation Threats

The explosive growth in leveraged futures positions introduces a potential risk for the market. When open interest builds quickly on a price rally without a comparable rise in spot buying, the market can become top-heavy. If ETH fails to defend key support levels, especially $2,000, a wave of forced liquidations could follow — accelerating any downside and shaking out overleveraged traders.

“A rapid buildup of open interest without continuous spot demand leaves the market vulnerable to deleveraging events.”

Outlook: Watch the $2,000 Level for Direction

Ethereum’s ability to hold above $2,000 will be critical in determining whether the bullish run has staying power. If spot demand picks up to match futures enthusiasm, the rally could extend higher. But if leveraged bets continue to dominate while spot interest lags, traders should prepare for potential volatility and sharp corrections.

- Ethereum futures open interest rose from $20.77B to $31.16B in two weeks.

- The surge followed — rather than anticipated — ETH’s breakout above $2,000.

- Retail-driven exchanges led the move, while institutional venues stayed cautious.

- Fragility remains if open interest isn’t backed by sustained spot demand.

For now, Ethereum’s next chapter will be written at the $2,000 level — and the interplay between spot buyers and leveraged traders will decide whether this surge leads to new highs or a swift reversal.