While central bank digital currencies (CBDCs) gain traction around the world, the United States remains on the sidelines. Years of studies, debates, and proposals have yielded no concrete direction — and now, under the current administration, the idea of a digital dollar has been effectively shut down.

What Are CBDCs?

CBDCs are government-issued digital currencies designed to replicate the functions of fiat money in an increasingly tokenized financial landscape. They aim to offer secure, transparent, and efficient alternatives to cash — especially as physical currency usage continues to decline worldwide. CBDCs are broadly categorized into:

- Retail CBDCs: Created for public use in day-to-day transactions.

- Wholesale CBDCs: Designed for interbank settlements and institutional transactions.

Supporters argue that CBDCs can improve financial inclusion, enhance monetary policy transmission, and act as a counterbalance to unregulated digital currencies such as stablecoins, meme coins, and other tokenized assets.

The US Ban on CBDCs

On January 16, 2025, Scott Bessent — President Donald Trump’s nominee for Treasury Secretary — firmly rejected the idea of a US-issued CBDC during his Senate confirmation. He cited privacy and economic control concerns as key objections.

Executive Action and Industry Response

Just a week later, President Trump signed an executive order officially prohibiting the development, issuance, and circulation of a CBDC in the US. This move effectively ended any short-term prospects for a digital dollar.

Crypto industry leaders were quick to respond. Vivek Raman, CEO of Etherealize.io, said:

“A CBDC goes against the principles of decentralization and freedom. It’s better to allow a marketplace of stablecoins and tokenized assets.”

Similarly, Rhett Shipp, CEO of Avant, emphasized the risks:

“CBDCs could reduce USD utility by making it more censorable and less private. Embracing stablecoins is the better path.”

CBDCs Around the World

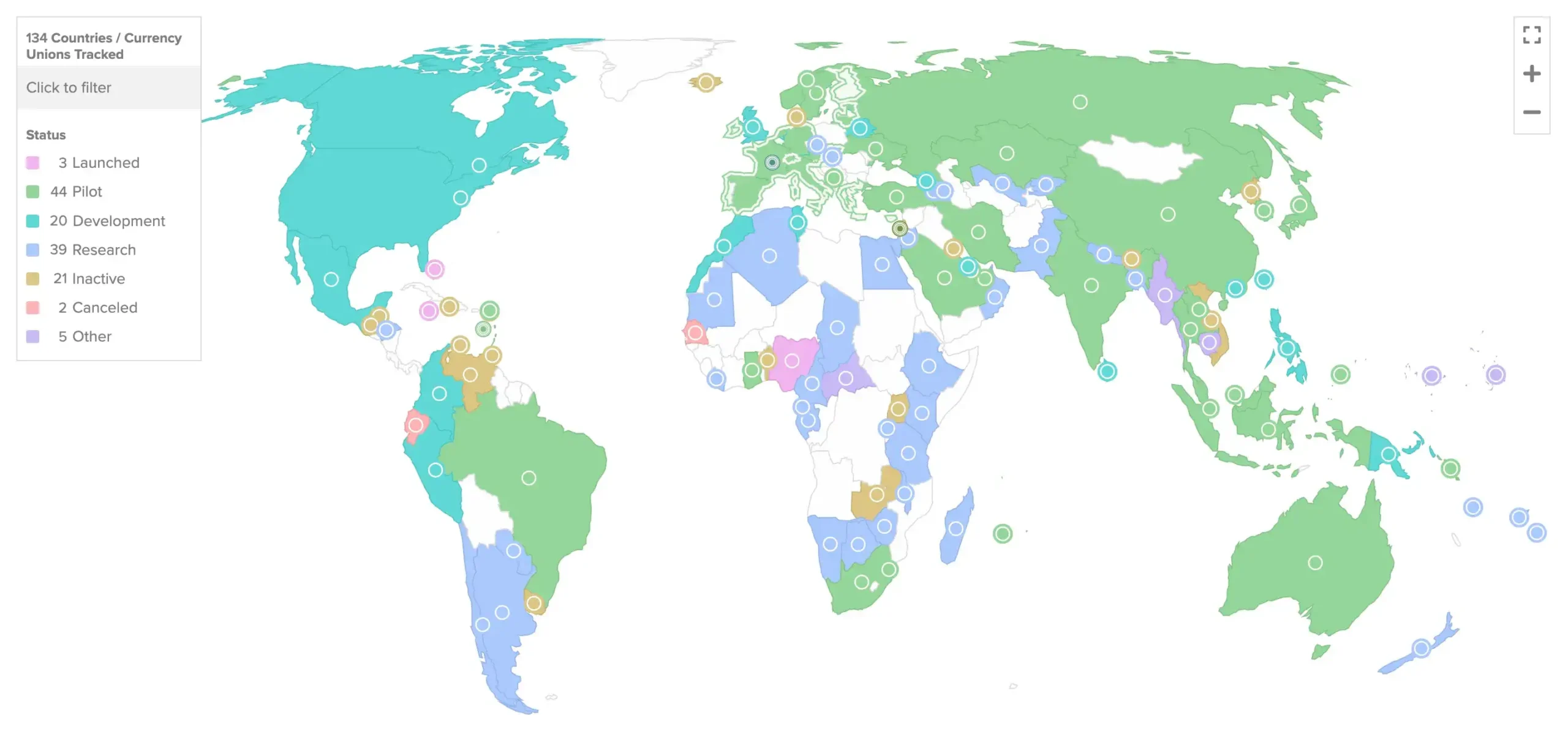

While the US exits the CBDC conversation, other countries are pushing forward. According to the Atlantic Council, 134 countries — accounting for 98% of global GDP — are exploring CBDCs. Only Nigeria, Jamaica, and the Bahamas have fully launched them so far.

China’s e-CNY: Leading the Way

China has rapidly advanced its CBDC efforts. Since piloting the e-CNY in 2019, the People’s Bank of China reports that, as of June 2024, the digital yuan has facilitated over $982 billion in transactions. With 260 million wallets across 17 regions, the e-CNY is the most utilized CBDC in the world.

The digital yuan is now accepted for a broad range of payments, including taxes, public transit, and digital “red envelopes” — all part of a push toward full-scale integration of tokenized payments in daily life.

Asia-Pacific and Global Coordination

Central banks in Asia-Pacific — including India, Indonesia, Thailand, Singapore, Japan, and South Korea — are actively testing or developing CBDCs. These initiatives aim to strengthen regional payment systems and improve cross-border transaction efficiency.

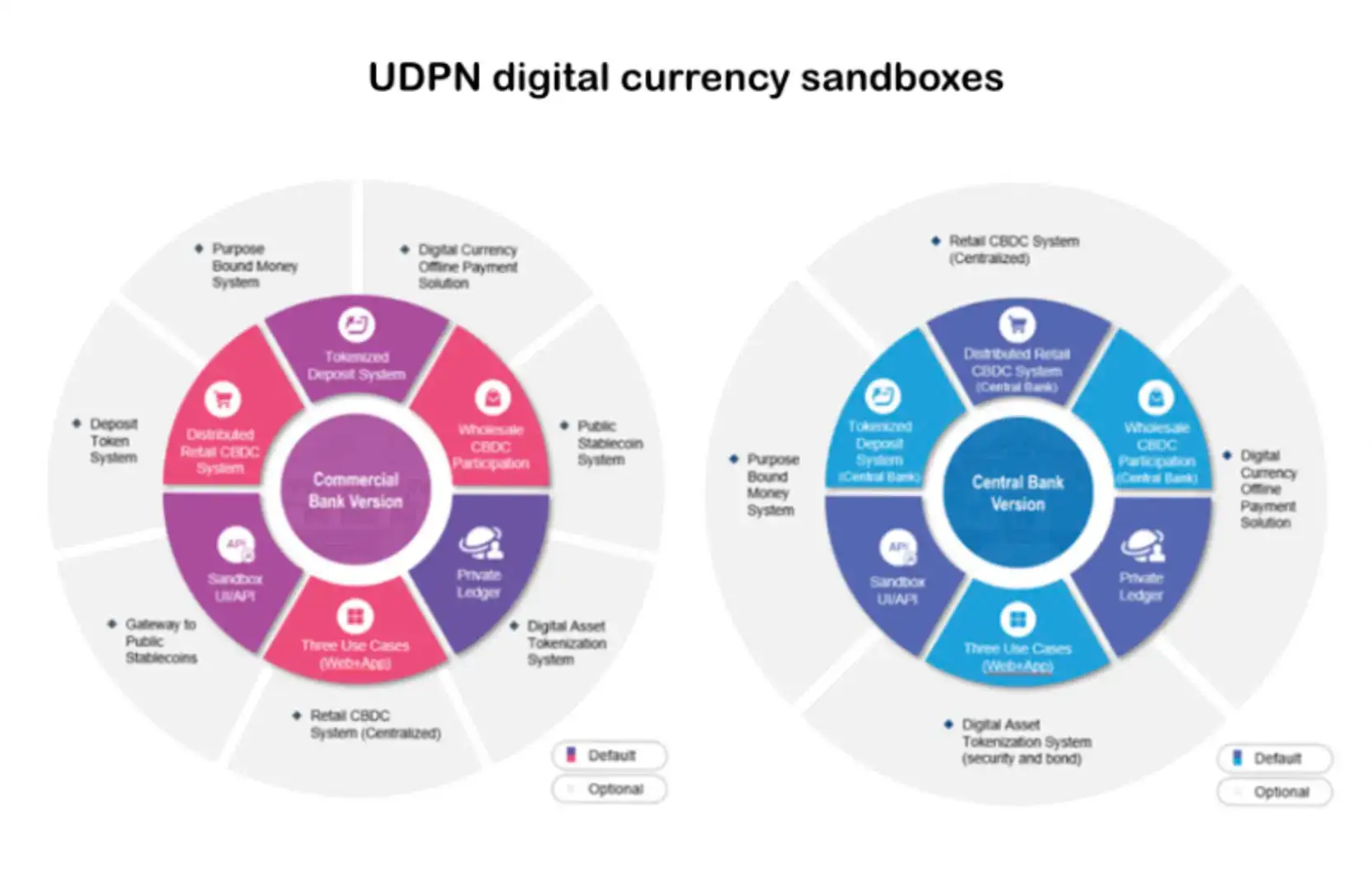

Red Date Technology, co-founder of China’s Blockchain-Based Service Network (BSN) and the Universal Digital Payments Network (UDPN), is at the forefront of developing infrastructure to connect CBDCs and stablecoins globally. UDPN has already onboarded institutions like Deutsche Bank and Standard Chartered into pilot programs simulating retail and wholesale CBDC use.

EU’s Wholesale CBDC Vision

Responding to geopolitical shifts, the European Central Bank announced on February 20, 2025, that it would accelerate development of a wholesale CBDC. This initiative, rolled out in two phases, aims to create a blockchain-based financial system where CBDCs, tokenized assets, and smart contracts can coexist on a shared infrastructure across the Eurozone.

The Privacy Debate and Political Divide

The American public and policymakers remain divided on the issue. CBDCs raise legitimate concerns — such as increased surveillance, financial censorship, and overreach by central authorities. These concerns, amplified by conservative and libertarian voices, have driven political resistance.

A Missed Opportunity or a Wise Pause?

Critics argue that by banning CBDCs, the US risks falling behind in global digital finance leadership. William Quigley, co-founder of Tether, remarked:

“Tokenization of finance is inevitable. As private digital assets grow, they will increasingly disintermediate commercial banks. Countries other than the US are adopting CBDCs while we criticize them.”

Still, others argue that the US approach allows time to assess risks and observe how other nations handle privacy, interoperability, and security challenges in their CBDC deployments.

The Global Future of Digital Money

Outside the US, 19 out of the 20 G20 countries are actively developing CBDCs. As blockchain infrastructure matures and tokenized payments expand, global financial systems are rapidly transforming — with or without American leadership.

The Bank for International Settlements continues to facilitate research and pilot programs across continents. Whether retail or wholesale, the future of CBDCs will be shaped by cross-border collaboration, legal harmonization, and public trust.

Conclusion

While the US remains cautious — or outright opposed — to implementing a digital dollar, the rest of the world is forging ahead with the CBDC era. The choice to abstain may be a principled stand for privacy and decentralization, but it could also mean ceding technological and monetary leadership to more agile economies.

As the financial world becomes increasingly tokenized, stablecoins and CBDCs are poised to play a central role. Whether the US will eventually re-enter the conversation — or be content to watch from the sidelines — remains to be seen.